Exness trading A Comprehensive Guide to Maximizing Your Profits

Understanding Exness Trading

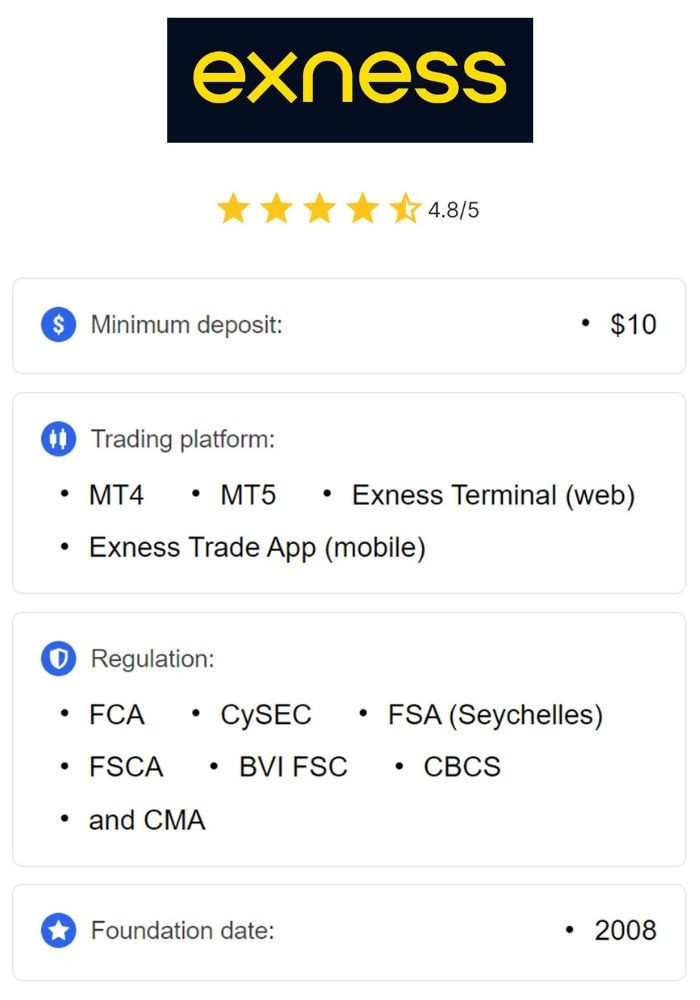

Exness trading provides an exceptional platform for both novice and experienced traders seeking to maximize their investment opportunities. With its user-friendly interface, diverse asset offerings, and extensive educational resources, Exness empowers traders to navigate the financial markets effectively. Whether you are looking to trade Forex, cryptocurrencies, or commodities, Exness offers tools and insights to enhance your trading experience. Check out this Exness trading https://testsub.watrbar.io/2025/05/19/how-to-invest-in-google-goog-shares-5/ to gain additional perspectives on trading.

Getting Started with Exness

To begin trading with Exness, you’ll first need to create an account. The process is relatively straightforward:

- Registration: Visit the Exness website and click on the registration button. Provide your email address, create a strong password, and select your country and preferred currency.

- Verification: Upload the necessary documents to verify your identity and address. This step is crucial for ensuring the safety of your account.

- Funding Your Account: Choose from various funding methods available, including bank transfers, credit cards, and e-wallets to deposit funds into your trading account.

- Choosing a Trading Platform: Exness offers multiple trading platforms, including MetaTrader 4 and MetaTrader 5. Select the one that best suits your trading style and strategy.

Understanding Different Asset Classes

Exness allows trading across various markets, enhancing your investment portfolio. Here’s a closer look at some asset classes available for trading:

- Forex: The Forex market is one of the largest financial markets globally, offering numerous currency pairs. Understanding market dynamics and economic indicators is vital for successful currency trading.

- Cryptocurrencies: With the rise of digital currencies, Exness enables the trading of popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading is highly volatile and requires a solid risk management strategy.

- Commodities: Trading commodities such as gold, silver, and oil can diversify your investment strategy. Prices are often influenced by global supply and demand, geopolitical tensions, and economic data.

Effective Trading Strategies

Successful trading on Exness relies on employing effective strategies tailored to your individual goals. Here are some popular trading strategies:

- Day Trading: This strategy involves executing multiple trades within a single day, capitalizing on short-term market movements. Successful day traders require quick decision-making skills and a constant watch on market news.

- Swing Trading: Swing traders aim to capture market movements over several days or weeks. This strategy requires patience and the ability to conduct thorough technical analysis to identify potential market swings.

- Scalping: Scalping involves making numerous small profits from tiny price changes throughout the day. It requires a strict exit strategy and the ability to make rapid trades.

Risk Management in Exness Trading

Understanding risk management is essential for any trader. Here are some key risk management techniques to implement while trading on Exness:

- Setting Stop-Loss Orders: A stop-loss order automatically closes your trade at a predetermined price, minimizing potential losses. Establishing stop-loss levels should be a fundamental part of your trading plan.

- Position Sizing: Determine the amount of capital to allocate to each trade based on your total account size and risk tolerance. Limiting exposure to any single trade can protect your overall portfolio.

- Diversification: Spreading your investments across various asset classes can reduce risk. Diversification ensures that poor performance in one area does not heavily impact your overall portfolio.

The Role of Market Analysis

Being informed about market conditions is crucial for successful trading. Here are two primary types of market analysis:

- Fundamental Analysis: This method involves evaluating economic indicators, company news, and overall market conditions to make informed trading decisions. Pay attention to announcements such as interest rate changes, employment figures, and GDP growth.

- Technical Analysis: Traders utilize charts and technical indicators to identify patterns and trends in price movements. Familiarizing yourself with tools like Moving Averages, RSI, and Fibonacci retracements can significantly enhance your trading strategies.

Utilizing Exness Trading Tools

Exness offers a plethora of trading tools and resources to support your trading journey. Leverage these tools to enhance your understanding of the financial markets:

- Economic Calendar: This tool helps traders keep track of upcoming economic events and news releases that could impact the markets.

- Trading Calculators: Use calculators to determine pip values, margin requirements, and profit/loss scenarios for your trades.

- Webinars and Educational Materials: Exness provides a vast library of educational resources including webinars, tutorials, and articles designed to improve trading knowledge and skills.

Conclusion

Choosing to trade with Exness opens up a world of opportunities in the financial markets. By understanding the platform, employing effective trading strategies, and practicing risk management, you can significantly enhance your trading journey. Always remember, trading involves risks, and it is essential to continuously educate yourself and adapt to market changes. With patience, diligence, and the right tools, you can make the most out of your Exness trading experience.